You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

BRIC+ News & comments

- Thread starter Billy T

- Start date

And western tech is moving to China to supplement the local Tech growth:

"... AstraZeneca Invests $200 Million in New Chinese Facility

Britain’s AstraZeneca announced today a $200 million investment in a new manufacturing facility in China. The new site represents the company's largest investment ever in a single manufacturing facility globally. The facility will produce intravenous and oral solid medicines. The construction is scheduled for completion at the end of 2013. ..."

From: http://pharmalive.com/news/index.cfm?articleID=807052&categoryid=9&newsletter=1

Many drug company R&D centers are moving there too - much cheaper & less red tape to run clinical trials in China.

"... AstraZeneca Invests $200 Million in New Chinese Facility

Britain’s AstraZeneca announced today a $200 million investment in a new manufacturing facility in China. The new site represents the company's largest investment ever in a single manufacturing facility globally. The facility will produce intravenous and oral solid medicines. The construction is scheduled for completion at the end of 2013. ..."

From: http://pharmalive.com/news/index.cfm?articleID=807052&categoryid=9&newsletter=1

Many drug company R&D centers are moving there too - much cheaper & less red tape to run clinical trials in China.

“…In the 16th Regular Meeting Putin will meet with Chinese premier Wen Jiabao, Chinese President Hu Jintao and other Chinese leaders. Talks are expected to include negotiations on a natural gas deal worth $1 trillion that has been stalled by disagreements over price. The deal would see Russia supply China with up to 68 billion cubic meters of gas every year. … Putin brings with him to China a group of 160 business leaders, including the CEOs of Russian energy giants Gazprom, Rosneft and aluminum producer UC RUSAL. …” From: http://edition.cnn.com/2011/10/11/business/china-putin-visit/index.html?hpt=hp_t2

Billy T, coining a new term, “Mortar Trade,” comments: The trade between the BRICs: The Mortar trade, is rapidly growing. For example, Brazil now trades much more with China than the US, imports more Chinese made cars than US made cars etc. Brazil pays for these items with it exports of iron ore, soy bean, etc. It is all part of China’s plan to shrink at least as a percentage, now and absolutely soon, the trade with the US.

China has long understood the US is broke, can only buy if China lends it the money, and wants to not accept decreasing value dollars for it goods and services. China wants and is rapidly growing its trade with other Asian nations that sell China low value added components China builds into its high value added production as they do not need loans to “buy Chinese.” Like Brazil, Canada’s trade with China is soaring and soon with the “wheat board” abolished, Canada’s farmers will be free to sell to China, getting better prices than the mandatory sales to Canada’s old, now or soon dead, wheat board. Expect higher prices in US for bread.

As dollar based trade shrinks, the mortar trade will grow, this trillion dollar deal (not in dollars) will be a big advance in the mortar trade. And it is not just the mortar trade that is expanding relative to that with the developed world. Here is small, but typical example from today's news:

"... Sun Jiazheng, vice-chairman of the 11th National Committee of Chinese People's Political Consultative Conference, China's top political advisory body, said the cooperation between China and countries of West Asia and Africa has become closer in recent years, especially in the field of economics and trade. The bilateral trade volume has been steadily increasing for consecutive years. ..." From: http://usa.chinadaily.com.cn/china/2011-09/28/content_13815592.htm

Last edited by a moderator:

You can watch (or just hear in the background) almost all of my quote below (and much more) in video here:

http://www.uncommonwisdomdaily.com/the-dark-continent-with-bright-opportunities-13134?FIELD9=3

"... According to the Heritage Foundation, estimates are that between 2005 and 2010 about 14 percent of China's total foreign investment went to sub-Saharan Africa. The fact is that Chinese appetite for resources is voracious. And items like Zambian copper, Nigerian oil, Tanzanian timber, and South African platinum are in high demand.

Chinese investment has paid for extensive roads in Ethiopia; financed the building of numerous schools and hospitals in Liberia; rebuilt Angola's once-famous Benguela railway; and set up a road-building program in Mozambique.*

Chinese investment has already rebuilt large parts of Africa and parts of Africa have much better infrastructure than they did even a few years ago. ..."

"...In fact, a whopping one-third of Chinese oil now comes from Africa. ... Africa has an abundance of key commodities scattered around the continent, including huge oil supplies, diamond and metals deposits, as well as farmland. ... business is booming right now in Africa thanks mostly to the vast and growing investments by the Chinese.

Trade between African nations and China surpassed $120 billion in 2010.** And in the past two years China has given major loans to poor African countries and is investing in everything from major agriculture projects to oil drilling and mining. ..."

Billy T comment:Un like most prior European colonizers (England excepted, at least in India) the Chinese are paying for what the take - winning friends - by improving the infrastructure. When the Belgiums left the Congo, they even took the phones back home!

--------------

* Mozambique's language is Portuguese, so you would think Brazilian business men would have a big advantage, and they are making some connections there, but can't match what the Chinese offer.

** Part of why in a few years China will tell the US (and EU a couple of years later) to "Go To Hell - We don't need to trade with you and will not loan you more funds to buy with (or finance your growing deficits.)"

http://www.uncommonwisdomdaily.com/the-dark-continent-with-bright-opportunities-13134?FIELD9=3

"... According to the Heritage Foundation, estimates are that between 2005 and 2010 about 14 percent of China's total foreign investment went to sub-Saharan Africa. The fact is that Chinese appetite for resources is voracious. And items like Zambian copper, Nigerian oil, Tanzanian timber, and South African platinum are in high demand.

Chinese investment has paid for extensive roads in Ethiopia; financed the building of numerous schools and hospitals in Liberia; rebuilt Angola's once-famous Benguela railway; and set up a road-building program in Mozambique.*

Chinese investment has already rebuilt large parts of Africa and parts of Africa have much better infrastructure than they did even a few years ago. ..."

"...In fact, a whopping one-third of Chinese oil now comes from Africa. ... Africa has an abundance of key commodities scattered around the continent, including huge oil supplies, diamond and metals deposits, as well as farmland. ... business is booming right now in Africa thanks mostly to the vast and growing investments by the Chinese.

Trade between African nations and China surpassed $120 billion in 2010.** And in the past two years China has given major loans to poor African countries and is investing in everything from major agriculture projects to oil drilling and mining. ..."

Billy T comment:Un like most prior European colonizers (England excepted, at least in India) the Chinese are paying for what the take - winning friends - by improving the infrastructure. When the Belgiums left the Congo, they even took the phones back home!

--------------

* Mozambique's language is Portuguese, so you would think Brazilian business men would have a big advantage, and they are making some connections there, but can't match what the Chinese offer.

** Part of why in a few years China will tell the US (and EU a couple of years later) to "Go To Hell - We don't need to trade with you and will not loan you more funds to buy with (or finance your growing deficits.)"

Last edited by a moderator:

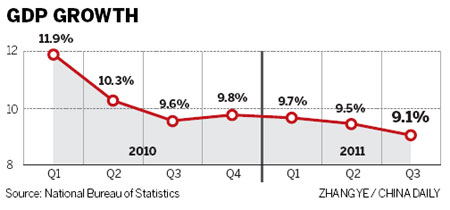

China’s Inflations rate is droppings as is its GDP easing down to a “soft landing.” Real salaries are growing more than 10% annully and the domestic sales at the retail level are now growing faster than exports:

China's export growth slowed to 17.5% in September from 24.5% in August. In September, the country's retail sales expanded 17.7 percent from a year earlier, following an increase of 17 percent in August. The retail sales grew 17 percent to 13.0811 trillion yuan ($2.05 trillion) in the first nine months from a year earlier.

Most of data and GDP graph quoted from China Daily articles today.

Billy T notes; 17.7% > 17.5% (September retail growth vs September export growth, both compared to August.) AND the retail growth is accelerating (September's 17.7% vs 17% for year to date i.e. last nine months) BUT export growth rate is dropping - down 7% from last month's (now 17.5 vs 24.5%)

China is switching to a more of a domestic economy, not there yet, but headed there, as I predicted it would.

Here is part of Jim Juback's article on the same new data:

"... There’s nothing in the underlying numbers, though, to suggest it’s time to worry about China’s economy coming in for a hard landing. ...

I think an actual reversal of central-bank policy {lower instead of rise interest and bank reserve requirements} will have to wait for the official inflation rate to come down further from September’s 6.1%. (That’s down from what looks like a peak of 6.5% in July.) But some economists are now projecting that inflation will take a big step down in the last months of the year. Deutsche Bank, for example, is projecting that inflation will drop to a 4% annual rate by December. ..."

From: http://www.moneyshow.com/investing/...ina-Slowdown-Could-Be-a-Blessing-in-Disguise/

PS if Deutsche Bank's 4% inflation in December 2011 for China is achieved, I predict US inflation for 2012 will be higher than China's inflation. Ben's flood of money will come out of US treasury bonds when a few more realize they are great way to lose purchasing power.

Last edited by a moderator:

"... Merck & Co. and the Singapore Economic Development Board said today they’ve a new agreement under which Merck will invest over $250 million over the next ten years in site improvements and expansions there along with another $700 million in local research activities. ..."

More details at: http://pharmalive.com/news/index.cfm?articleID=809351&categoryid=9&newsletter=1

Billy T comment:700+250 is essentially a billion dollars* going to Asia from Merck alone - Many other drug companies are also expanding in Asia, in part because of the growing market and cheaper labor (same reasons as car makers are expanding there etc.) but also because it is much cheaper to run clinical trials there.

(And no $100,000 law suits because some old man's tooth fell out after taking their drug etc.)

* much more when annual salaries are counted.

More details at: http://pharmalive.com/news/index.cfm?articleID=809351&categoryid=9&newsletter=1

Billy T comment:700+250 is essentially a billion dollars* going to Asia from Merck alone - Many other drug companies are also expanding in Asia, in part because of the growing market and cheaper labor (same reasons as car makers are expanding there etc.) but also because it is much cheaper to run clinical trials there.

(And no $100,000 law suits because some old man's tooth fell out after taking their drug etc.)

* much more when annual salaries are counted.

Last edited by a moderator:

“… The Mekong River flows through China, Myanmar, Laos, Thailand, Cambodia and Vietnam to the South China Sea. It plays a crucial role in trade and transport throughout the Greater Mekong Sub-region (GMS) countries, namely China, Myanmar, Thailand, Laos, Cambodia and Vietnam.

China and the Association of Southeast Asian Nations (ASEAN), two of Asia's most dynamic economies, are set to overcome differences and difficulties to forge closer ties and sustain growth as uncertainties weigh on the world economy. {Bold added by Billy T}

Bilateral trade ballooned after the launch of China-ASEAN Free Trade Area (CAFTA) in 2010, which reduced the average tariff on goods traded between China and a majority of ASEAN countries to near zero. China and ASEAN saw trade surge 37.5 percent year-on-year to 292.8 billion U.S. dollars in 2010, almost 37 times the amount in 1991, customs figures showed. …”

From: http://usa.chinadaily.com.cn/china/2011-10/23/content_13958009.htm

Billy T comment: A good specific example of what I have been posting for years. China is rapidly growing its trade with other Asian nations as it knows the US and EU are broke and can only buy, if China lends them the money. China is also rapidly growing its trade with the suppliers of energy, raw materials and food stocks it needs (like Brazil and Canada) as they too do not need Chinese loans to buy. China's trade with African suppliers is also soaring: "Trade between African nations and China surpassed $120 billion in 2010." & China's investment in Africa is up 14% in only 5 years - See more details in post 464.

Two Senators are hoping China will help end the housing collapse in US:

"Democratic Senator Chuck Schumer and Republican Senator Mike Lee, would allow Chinese nationals, who are currently required to apply for a new US visa every year, to seek five-year, multiple-entry visitor visas, ..." (if they buy a $500,000 house in the US & live in it 1/2 the year so must pay taxes to US also, etc.) See details here: http://usa.chinadaily.com.cn/us/2011-10/22/content_13954558.htm

Man does not live by bread alone, but without Chinese "bread" the US collapses.

China and the Association of Southeast Asian Nations (ASEAN), two of Asia's most dynamic economies, are set to overcome differences and difficulties to forge closer ties and sustain growth as uncertainties weigh on the world economy. {Bold added by Billy T}

Bilateral trade ballooned after the launch of China-ASEAN Free Trade Area (CAFTA) in 2010, which reduced the average tariff on goods traded between China and a majority of ASEAN countries to near zero. China and ASEAN saw trade surge 37.5 percent year-on-year to 292.8 billion U.S. dollars in 2010, almost 37 times the amount in 1991, customs figures showed. …”

From: http://usa.chinadaily.com.cn/china/2011-10/23/content_13958009.htm

Billy T comment: A good specific example of what I have been posting for years. China is rapidly growing its trade with other Asian nations as it knows the US and EU are broke and can only buy, if China lends them the money. China is also rapidly growing its trade with the suppliers of energy, raw materials and food stocks it needs (like Brazil and Canada) as they too do not need Chinese loans to buy. China's trade with African suppliers is also soaring: "Trade between African nations and China surpassed $120 billion in 2010." & China's investment in Africa is up 14% in only 5 years - See more details in post 464.

Two Senators are hoping China will help end the housing collapse in US:

"Democratic Senator Chuck Schumer and Republican Senator Mike Lee, would allow Chinese nationals, who are currently required to apply for a new US visa every year, to seek five-year, multiple-entry visitor visas, ..." (if they buy a $500,000 house in the US & live in it 1/2 the year so must pay taxes to US also, etc.) See details here: http://usa.chinadaily.com.cn/us/2011-10/22/content_13954558.htm

Man does not live by bread alone, but without Chinese "bread" the US collapses.

Last edited by a moderator:

I have several times posted that China buys into companies when it wants their technology*, even specifically mentioning Gas from shale "fracking" and noted that China has huge potential production of gas (and condensate liquids) from its shale deposits but never before had hard data:

"... China is estimated to hold more natural gas trapped in shale than the US, according to the US Energy Information Administration in April. Shale gas is among the largest onshore energy prospects in China.

CNOOC paid $570 million for a 33.3-percent stake in Chesapeake Energy Corp's Niobrara shale project in Colorado and Wyoming in February this year.

Last November, the company made a $1.8-billion purchase for a one-third stake in Chesapeake's Eagle Ford project in south Texas. ..."

From: http://usa.chinadaily.com.cn/epaper/2011-10/25/content_13969965.htm

*China's other main approach is to only open their huge market to companies with technology they want. For example German companies built the first high-speed trains in China, then China with money and many Chinese engineers made them better - to become the world's fastest.

Soon, I predict, that the technology for the best Rare Earth magnets, now found in Japan's Hitachi, will be going to China. Hitachi gets assured access to the REs and cheaper labor cost & China gets the world's leading magnet technology, and may make it even better. - They don't educate twice as many high level engineers as the US does for no good reason.

"... China is estimated to hold more natural gas trapped in shale than the US, according to the US Energy Information Administration in April. Shale gas is among the largest onshore energy prospects in China.

CNOOC paid $570 million for a 33.3-percent stake in Chesapeake Energy Corp's Niobrara shale project in Colorado and Wyoming in February this year.

Last November, the company made a $1.8-billion purchase for a one-third stake in Chesapeake's Eagle Ford project in south Texas. ..."

From: http://usa.chinadaily.com.cn/epaper/2011-10/25/content_13969965.htm

*China's other main approach is to only open their huge market to companies with technology they want. For example German companies built the first high-speed trains in China, then China with money and many Chinese engineers made them better - to become the world's fastest.

Soon, I predict, that the technology for the best Rare Earth magnets, now found in Japan's Hitachi, will be going to China. Hitachi gets assured access to the REs and cheaper labor cost & China gets the world's leading magnet technology, and may make it even better. - They don't educate twice as many high level engineers as the US does for no good reason.

Workaholic

Registered Senior Member

A short article about China's potential bailout of the EU. Mostly speculation about why or why not China would want to bailout the EU, but I found part of it interesting:

http://www.philstar.com/Article.aspx?articleId=744781&publicationSubCategoryId=64

Remark: So will China increase power in the IMF or will it continue on its current bi-lateral trade pact path? IMO, it won't offer a substantial EU bailout and will continue with what is working so far.

Anyone disagree?

However, as Subramanian suggests, by substantially raising its shares China can gain equal veto power as the US, and probably a greater status than the EU, in managing the IMF.

That won’t sit well with the US; it’s not ready to ease its tight grip on IMF policy-making, or share power with China. But Subramanian argues that such step is along what the US wants — to “tether China more firmly to, and create a stake for it in, the multilateral system.”

The alternative is worse, he points out, adverting to China’s successful bilateral economic ventures worldwide: “A China that uses its might bilaterally to gain narrow political advantages would be a worrying portent for the future when China becomes economically bigger and stronger.”

http://www.philstar.com/Article.aspx?articleId=744781&publicationSubCategoryId=64

Remark: So will China increase power in the IMF or will it continue on its current bi-lateral trade pact path? IMO, it won't offer a substantial EU bailout and will continue with what is working so far.

Anyone disagree?

No, but that does not mean China will not help the EU's economies with more jobs and budgets with greater tax collections, while giving the Chinese population a better life*:... IMO {China} won't offer a substantial EU bailout and will continue with what is working so far. Anyone disagree?

“… Chinese perceive their currency reserve as a nest egg built on the back of 30 years hard work building its economy, said Patrick Chovanec of Tsinghua University. … Beijing can't be seen to be just investing this money willy-nilly. They need to make a case that they're going to earn a reliable return." Chovanec said.

{Although} a slowdown in the EU {China’s largest trading partner at 20% of its exports, 11% more than with the US} would hurt China, it wouldn't raise the specter of widespread unemployment, he added. "China's labor market is fully employed ... there are widespread shortages of manual labor. Any economic slowdown (from reduced EU demand) is not likely to see widespread unemployment."

"The real way Chinese can help Europe is by using some of the $3 trillion worth of reserves they've piled up to stimulate consumption {of EU products by Chinese} ... and help create jobs, earnings and opportunity in Europe," Chovanec said. …”

From: http://edition.cnn.com/2011/11/03/world/asia/china-g20-eu-bailout/index.html?hpt=hp_t1

* That helps the CCP to hold on to power. - It is very popular with the mass because no one starves any more and every year for more than decade their lives are materially better. A desire for "Freedom of the press", etc. comes to the masses ONLY after more than a generation with full bellies and only fading memories of starvation. If you were Chinese, would you want to change a government that has made China from a nothing to world's No. 2 power and is raising the REAL purchasing power of your salary >10% annually with full employment (actually labor shortages) for all?

You had just better hope the OWSers don't learn how the Chinese do it. - If they do and gain real political power, the US will adopt Chinese style government. For example: No public hearing and years of delay for the Keystone Pipeline bringing Canada's shale oil to the US's Gulf coast refineries. - The Government will just build it and keep the profits and lower your taxes instead of letting international corporations make huge profits selling oil (gasoline) to Americans. Do you know gasoline is cheap in China and real estate taxes did not exist until recently when very tiny ones started being experimentally introduced in some districts? (Mainly to discourage speculative investing in the housing market, not for government revenue.)

Last edited by a moderator:

China too (along with US & EU, which started in 2008 and will have all banded by 2012) will ban sale of 100W higher incandescent bulbs in October 2012. 60W bulbs to be illegal in October 2014, with 15W gone by 2016. Then 48 million tons less CO2 will be released by China. Currently 12% of China's electric power is for light bulbs.

From: http://www.moneyshow.com/investing/article/39/Jubak_Picks-25243/When-the-Lights-Go-Down.../

From: http://www.moneyshow.com/investing/article/39/Jubak_Picks-25243/When-the-Lights-Go-Down.../

"... Last week the Guangdong province, where many of China's factories are concentrated, announced a 20% increase to the minimum wage. Combined with two earlier hikes in April and July, the total increase over the past 10 months is a startling 42%.

And with an eye toward booting domestic consumption, the government plans to keep the raises coming - on average 20% a year through 2015. ..."

From: http://moneymorning.com/2011/11/10/rising-wages-in-china-good-for-glocals-but-few-jobs-coming-back/

Don't let the ows get wind of a 42% salary hike in only 10 months! God only knows what they might do.

And with an eye toward booting domestic consumption, the government plans to keep the raises coming - on average 20% a year through 2015. ..."

From: http://moneymorning.com/2011/11/10/rising-wages-in-china-good-for-glocals-but-few-jobs-coming-back/

Don't let the ows get wind of a 42% salary hike in only 10 months! God only knows what they might do.

"... China had offered help in return for European support to grant it either more influence at the International Monetary Fund, market economy status in the World Trade Organization, or the lifting of a European arms embargo ... sources in Beijing say that this {IMF} option was abruptly closed to China when it became clear to EU politicians that {China got} a greater say in IMF decision-making and a more rapid path to inclusion of China's Yuan in the IMF's special drawing rights (SDR) currency unit.

Increasing China's say at the IMF would mean reducing EU representation and possibly diluting the influence of the United States, which enjoys veto-power status given its voting rights at the Fund. "We {China} are willing to help, but we are not a charity," the source with leadership ties told Reuters. ...

Europe's rejection of China's demands -- particularly the inclusion of the renminbi in the SDR -- was tantamount to "a slap in the face," said the source. That could make it even less likely that Beijing will ride to Europe's rescue with a huge cash infusion that some Chinese sources say could be as large as $100 billion. ..."

From: http://www.reuters.com/article/2011/11/11/us-china-europe-idUSTRE7AA1Q820111111

Billy T comment:It appears that the EU would rather try to stop its disintegration without Chinese funds than allow China to gain greater influence in the world's monetary system.

There is great profit to be had by controlling the world's monetary system, especially for the US and to a lesser extent by several others. I.e. they can print currency and use this paper to import real goods without the newly printed money always causing bad inflation. I.e. China and others keep it out of circulation as if it did not exist. China understandably wants a piece of the "buy goods for printed paper" action.

Increasing China's say at the IMF would mean reducing EU representation and possibly diluting the influence of the United States, which enjoys veto-power status given its voting rights at the Fund. "We {China} are willing to help, but we are not a charity," the source with leadership ties told Reuters. ...

Europe's rejection of China's demands -- particularly the inclusion of the renminbi in the SDR -- was tantamount to "a slap in the face," said the source. That could make it even less likely that Beijing will ride to Europe's rescue with a huge cash infusion that some Chinese sources say could be as large as $100 billion. ..."

From: http://www.reuters.com/article/2011/11/11/us-china-europe-idUSTRE7AA1Q820111111

Billy T comment:It appears that the EU would rather try to stop its disintegration without Chinese funds than allow China to gain greater influence in the world's monetary system.

There is great profit to be had by controlling the world's monetary system, especially for the US and to a lesser extent by several others. I.e. they can print currency and use this paper to import real goods without the newly printed money always causing bad inflation. I.e. China and others keep it out of circulation as if it did not exist. China understandably wants a piece of the "buy goods for printed paper" action.

Last edited by a moderator:

"... shipments to China rose to a record 24m during the period, compared with 23m for the US, according to research done by Strategy Analytics. The consultancy said shipments to China were boosted by "a wave of low-cost Android models from local Chinese brands". ...

shipments to China grew by 58%, those to the US fell by 7%. ..."

From: http://www.bbc.co.uk/news/business-15850028

Not much in way of news (China has long been biggest "dumb phone" market.)* but I thought the ladies would brighten up the thread.

* One model (phone, that is) even has a refillable chamber (remember the prior parrends

"... The agreement, signed by President Hu Jintao and Turkmen President Gurbanguly Berdymukhamedov ... will increase annual gas deliveries ... bringing the annual total to 65 billion cubic meters "in the near future" ...

The figure - 65 billion cubic meters - is equivalent to more than half of China's entire natural gas consumption last year. During their meeting, Hu also pledged to deepen energy cooperation with Turkmenistan and establish "a long-term and stable strategic energy partnership" following the success of a natural gas pipeline between the two countries, which became operational in 2009.

China, the world's second-largest economy, has been diversifying and expanding access to energy needed to power its fast-growing economy and reduce its reliance on heavily polluting coal. ..."

From: http://usa.chinadaily.com.cn/china/2011-11/24/content_14153191.htm

Billy T comment: More of the same - China is securing it energy supplies all over the world for at least the next 25 years often paying up front, especially for oil, with long term decreasing value dollars from its reserves.

At least the four aircraft carrier blue water fleet China is building will not be needed to make sure deliveries occur, as paid for, on this one.

The figure - 65 billion cubic meters - is equivalent to more than half of China's entire natural gas consumption last year. During their meeting, Hu also pledged to deepen energy cooperation with Turkmenistan and establish "a long-term and stable strategic energy partnership" following the success of a natural gas pipeline between the two countries, which became operational in 2009.

China, the world's second-largest economy, has been diversifying and expanding access to energy needed to power its fast-growing economy and reduce its reliance on heavily polluting coal. ..."

From: http://usa.chinadaily.com.cn/china/2011-11/24/content_14153191.htm

Billy T comment: More of the same - China is securing it energy supplies all over the world for at least the next 25 years often paying up front, especially for oil, with long term decreasing value dollars from its reserves.

At least the four aircraft carrier blue water fleet China is building will not be needed to make sure deliveries occur, as paid for, on this one.

"... "China is a vaccine-producing power" with more than 30 companies that have an annual production capacity of nearly 1 billion doses — the largest in the world, the country's State Food and Drug Administration told The Associated Press.

China's entry into this market will be a "game changer," said Nina Schwalbe, head of policy at the GAVI Alliance*, which buys vaccines for 50 million children a year worldwide. "We are really enthusiastic about the potential entry of Chinese vaccine manufacturers," she said.

China's vaccine-making prowess captured world attention in 2009 when one of its companies developed the first effective vaccine against swine flu — in just 87 days — as the new virus swept the globe. In the past, new vaccine developments had usually been won by the U.S. and Europe.

Then, this past March the World Health Organization announced that China's drug safety authority meets international standards for vaccine regulation. It opened the doors for Chinese vaccines to be submitted for WHO approval so they can be bought by U.N. agencies and the GAVI Alliance. ..."

From: AP as copied at: http://news.yahoo.com/china-prepares-big-entry-vaccine-market-072555312.html

Billy T: Another area of export earnings, where US lead soon to be lost to China.

* Unless memory fails me that it the huge organization Bill Gates created and his main effort now days.

China's entry into this market will be a "game changer," said Nina Schwalbe, head of policy at the GAVI Alliance*, which buys vaccines for 50 million children a year worldwide. "We are really enthusiastic about the potential entry of Chinese vaccine manufacturers," she said.

China's vaccine-making prowess captured world attention in 2009 when one of its companies developed the first effective vaccine against swine flu — in just 87 days — as the new virus swept the globe. In the past, new vaccine developments had usually been won by the U.S. and Europe.

Then, this past March the World Health Organization announced that China's drug safety authority meets international standards for vaccine regulation. It opened the doors for Chinese vaccines to be submitted for WHO approval so they can be bought by U.N. agencies and the GAVI Alliance. ..."

From: AP as copied at: http://news.yahoo.com/china-prepares-big-entry-vaccine-market-072555312.html

Billy T: Another area of export earnings, where US lead soon to be lost to China.

* Unless memory fails me that it the huge organization Bill Gates created and his main effort now days.

China's imports are growing, especially for the ever richer population and even if much of what is imported is by the government it is mainly for the people to use. Gold and silver imports are surging. Instead of being illegal only three years ago for Chinese to hold gold and silver, China is now very actively promoting their population to buy gold and silver.

Bars are billions of dollars each month.

Bars are billions of dollars each month.

Photo is from post 115 in old "gold thread": That is image of the silver "panda bars" China issued to commemorate 60 years of communistic rule and prosperity which China is now encouraging its population to hoard:

Photo is from post 115 in old "gold thread": That is image of the silver "panda bars" China issued to commemorate 60 years of communistic rule and prosperity which China is now encouraging its population to hoard:

If each of 1.33E9 Chinese each hoards one bar (on average) per year, that is 1.33E9x0.02 Kg = 2.66E7Kg / year or 58,520,000 lbs/year or 936,320,000 ounces / year. That is more than 100% of global new silver production which is ~800 million oz. And Silver consumption & investment demand is already greater than global production. Why price of sliver will soar in the next few years.

Bars are packed in air tight seal - many will be buried in the ground as rural Chinese have done for centuries - they don't trust banks. Urbanites however do and now are allowed by many banks to open gold accounts. I.e. instead of your account being credited by X RMBs it is credited with Y ounces of gold. China has been world's largest gold producer of more than three years, and sells none - Quite the contrary, China soon will pass India as world's largest gold buyer.*

As I posted some years ago, I think China will back its bonds with gold (for central banks only) to destroy the Dollar as the world's preferred reserve currency when that will be to China's economic advantage. Few central banks will actually ask for gold, which cost to store, instead of hold interest paying bonds -just as is the case now.

* "... SHANGHAI -(Dow Jones)- China may pass India to become the world's largest gold consumer as soon as next year, underpinned by rising demand from a richer population, Standard Bank's head of commodity strategy said Tuesday. ..."

From: http://www.nasdaq.com/aspx/stock-ma...cious-metals-highlightstop-stories-of-the-day

If each of 1.33E9 Chinese each hoards one bar (on average) per year, that is 1.33E9x0.02 Kg = 2.66E7Kg / year or 58,520,000 lbs/year or 936,320,000 ounces / year. That is more than 100% of global new silver production which is ~800 million oz. And Silver consumption & investment demand is already greater than global production. Why price of sliver will soar in the next few years.

Bars are packed in air tight seal - many will be buried in the ground as rural Chinese have done for centuries - they don't trust banks. Urbanites however do and now are allowed by many banks to open gold accounts. I.e. instead of your account being credited by X RMBs it is credited with Y ounces of gold. China has been world's largest gold producer of more than three years, and sells none - Quite the contrary, China soon will pass India as world's largest gold buyer.*

As I posted some years ago, I think China will back its bonds with gold (for central banks only) to destroy the Dollar as the world's preferred reserve currency when that will be to China's economic advantage. Few central banks will actually ask for gold, which cost to store, instead of hold interest paying bonds -just as is the case now.

* "... SHANGHAI -(Dow Jones)- China may pass India to become the world's largest gold consumer as soon as next year, underpinned by rising demand from a richer population, Standard Bank's head of commodity strategy said Tuesday. ..."

From: http://www.nasdaq.com/aspx/stock-ma...cious-metals-highlightstop-stories-of-the-day

Last edited by a moderator:

New apartment prices have been reduced 10 to 15% as developer's sales slowed in China. Many who bought only a few months earlier want refunds and are making street demonstrations, etc. Arrest are being made when protesters cause damage.- Like US's "occupy movements."

No tear gas, pepper spray used.

No tear gas, pepper spray used.

Billy T comment: The Chinese government has succeed with its tight money, (Thus now with "success", today China slightly lowered bank reserve requirements: 20.5 to 20.0% now. - It does much better than the FED in making growth (>9%) without excessive inflation, which is now (~5.5%) and dropping too and jobs for all.) and loan controls, etc. to end the "housing bubble" - which the western press speak of but only is true in a few major, not most, cities:

"Urban residential values have risen 155 percent nationwide since reforms 13 years ago created a private residential market in the communist nation. Prices in Shanghai almost quadrupled over the past decade...." From: http://www.bloomberg.com/news/2011-...sters-as-shattered-dreams-vex-government.html

(Has story of too early buyer who bought because his girl made that a condition to marry him. I think this is relatively common in China.)

IMHO, what the government should do is tell the protesters that buying home is not a guarantee to increase in value. That the home owners in the US falsely believed it was too, but now have seen the prices fall 35 to 40% from the peak of a few years ago and they are still dropping in most US cities. I.e. tell these protesters you are lucky to live in a growing country with jobs for everyone - not in a decaying one like the US. Be thankful you have not lost 1/3 of your saving as many Americans have.

BTW, one not frequently mentioned reason for the housing bubble in the main high-wage cities was the lack of attractive alternative investments. Banks, even their "CDs" did not pay interest high enough to offset the erosion of inflation. Investing outside of China was illegal (except for the very well connected few). The local stock market essentially did not exist. States owned the land, farmers could not sell (still can't) their land - only lease it and that too was illegal until about 3 years ago. Owning gold or silver as an investment was illegal until about 3 years go.

Now the people are being encouraged to buy Gold (use the new gold bank accounts - not get hands on the gold) and silver (which you can get and bury in the back yard if you like). Some can buy stocks (in Hong Kong) too. So buying an apartment to rent is no longer the only way to invest. (One can, and many wealthy have for years, lent money to others with attractive interest charged, and with little formality and nothing recorded by governments. - but need to "keep face" has made almost zero default rates as lending is by an informal groups who see the borrowers every day.)

Later by edit:This is hard on the developers too - 80% are at least one month behind on their loans from the bank.

Billy T comment: The Chinese government has succeed with its tight money, (Thus now with "success", today China slightly lowered bank reserve requirements: 20.5 to 20.0% now. - It does much better than the FED in making growth (>9%) without excessive inflation, which is now (~5.5%) and dropping too and jobs for all.) and loan controls, etc. to end the "housing bubble" - which the western press speak of but only is true in a few major, not most, cities:

"Urban residential values have risen 155 percent nationwide since reforms 13 years ago created a private residential market in the communist nation. Prices in Shanghai almost quadrupled over the past decade...." From: http://www.bloomberg.com/news/2011-...sters-as-shattered-dreams-vex-government.html

(Has story of too early buyer who bought because his girl made that a condition to marry him. I think this is relatively common in China.)

IMHO, what the government should do is tell the protesters that buying home is not a guarantee to increase in value. That the home owners in the US falsely believed it was too, but now have seen the prices fall 35 to 40% from the peak of a few years ago and they are still dropping in most US cities. I.e. tell these protesters you are lucky to live in a growing country with jobs for everyone - not in a decaying one like the US. Be thankful you have not lost 1/3 of your saving as many Americans have.

BTW, one not frequently mentioned reason for the housing bubble in the main high-wage cities was the lack of attractive alternative investments. Banks, even their "CDs" did not pay interest high enough to offset the erosion of inflation. Investing outside of China was illegal (except for the very well connected few). The local stock market essentially did not exist. States owned the land, farmers could not sell (still can't) their land - only lease it and that too was illegal until about 3 years ago. Owning gold or silver as an investment was illegal until about 3 years go.

Now the people are being encouraged to buy Gold (use the new gold bank accounts - not get hands on the gold) and silver (which you can get and bury in the back yard if you like). Some can buy stocks (in Hong Kong) too. So buying an apartment to rent is no longer the only way to invest. (One can, and many wealthy have for years, lent money to others with attractive interest charged, and with little formality and nothing recorded by governments. - but need to "keep face" has made almost zero default rates as lending is by an informal groups who see the borrowers every day.)

Later by edit:This is hard on the developers too - 80% are at least one month behind on their loans from the bank.

Last edited by a moderator:

Billy T comment: This an unbelievable cost to someone. Probably to STX, and its insurance company, if they are the owner as stated by Reuters, but only if Vale can prove the loading was done correctly). Just the interest lost on the capital not being used (and the iron ore) each day would allow you to live very well for 40 years in luxury retirement!

Fortunately for Vale (and Brazil) Vale only had the ship under long term lease - does not own it -but still will lose a fortune on the undelivered or delayed delivery ore. I am not sure there is a repair yard in Brazil large enough to fix it. I would like to know what happen. This was the first trip of ship delivered only in September this year. As usual, only the lawyers will come out of this smelling like a rose.

* Not quite accurate: It was moved by tugs to get it out of the shipping channel - I think it is sitting at anchor, not in a repair yard, now. If it had sunk where shown in photo, China and others needing iron ore would take an economic hit too - as that would block this port for months, reducing by at least 10% the world's supply of iron ore.

Here it is stated that Vale owns it:

"... The ship belongs to Vale, the Brazilian iron ore miner, and has been controversial since entering service this year. Its first cargo was redirected to Italy after Chinese ports refused the Vale Beijing entry {another smart move by China} in a dispute over the introduction of these massive new vessels.

... there is a trend in the shipping industry to build larger vessels to reduce the unit cost of transporting goods across the world. The Vale Beijing is more than twice the size of the existing fleet of bulk commodities carriers and there are plans to move to 600,000-tonne vessels, which has raised questions about their structural strength. ..."

From: http://www.theaustralian.com.au/new...ips-springs-leak/story-e6frg6so-1226215965368

More Billy T comment:Ship has a cracked hull - is leaking water. If it sinks there will be (I think) a much larger oil leak than the recent 2,400 barrels one Chevron made about 100 miles off the Brazilian coast (near Rio) and was fined 28 millions for doing so. If Vale did improperly load it and ship sinks near to Brazilian coast, it will be interesting to see if Brazil fines Vale much more than 28 Million as Brazil is the majority owner of Vale.

I note from photo and the water line that ship is lower in the water at the stern. I don't know when photo was taken. That could be just effect of water ship has taken on board via the crack or improper loading if photo was made before ship's hull cracked.

Most do not know how the huge wake-following USSR's torpedoes could have sunk a US aircraft carrier. They were the size of a small submarine! Not by hitting the carrier but by exploding perhaps 100 meters below it. I.e. make a big gas bubble about half as long as the carrier under its center with end of the carrier still supported by water but the center falls into the hole - braking carrier into two pieces that sink. You can break any big ship if one end is pushed down significantly more than the other. - They are not strong enough to avoid cracking apart.

This second article (published at December 07, 2011 11:17AM Australian time) mentions that the ore alone is worth 50 million dollars.

Last edited by a moderator:

Interesting article over at foreignpolicy.com reappraising the BRIC grouping on the tenth aniversary of the term's coinage:

http://www.foreignpolicy.com/articles/2011/12/02/rise_of_the_timbis

The basic suggestion is that Russia and China no longer belong in the grouping, and should be replaced by Turkey, Mexico and Indonesia (resulting in the acronym TIMBI).

http://www.foreignpolicy.com/articles/2011/12/02/rise_of_the_timbis

The basic suggestion is that Russia and China no longer belong in the grouping, and should be replaced by Turkey, Mexico and Indonesia (resulting in the acronym TIMBI).

Nov. 30 marked the 10th anniversary of Goldman Sachs economist Jim O'Neill's anointing of the BRIC economies -- Brazil, Russia, India, and China -- as the future leaders of the global economy. Yet 10 years on, the notion of the BRICs already seems out of date. In China and Russia, demographic patterns have shifted. Their working-age populations are declining, as are exports, while still-rigid political systems stifle free thought and hamper technical advance.

Future trends still look robust in Brazil and India, but these countries should now be in new company -- a group of dynamic and democratic emerging economies. Let's call them the TIMBIs: Turkey, India, Mexico, Brazil, and Indonesia. These countries form more than just a cute acronym. They all share favorable demographics and democracy and are already large economies. Their GDPs combined have already surpassed that of China and will be much faster growing in the coming decades. Their combination of booming labor forces and political openness points to rapid increases in human capital and innovation that will propel these regional powers into global powers in the near future.

Future trends still look robust in Brazil and India, but these countries should now be in new company -- a group of dynamic and democratic emerging economies. Let's call them the TIMBIs: Turkey, India, Mexico, Brazil, and Indonesia. These countries form more than just a cute acronym. They all share favorable demographics and democracy and are already large economies. Their GDPs combined have already surpassed that of China and will be much faster growing in the coming decades. Their combination of booming labor forces and political openness points to rapid increases in human capital and innovation that will propel these regional powers into global powers in the near future.