You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

China ± USA $ future issues? ......

- Thread starter R1D2

- Start date

Billy T´s excerpts from 2 September 2012 speech by Wen Jiabao, Premier of China, to nearly 90 leaders from Eurasian countries and international organizations and more than 1,000 Chinese and foreign entrepreneurs at the Opening Session of at the Second China-Eurasia Expo. Last year, the Chinese government upgraded the 19-year-old Urumqi Foreign Economic Relations and Trade Fair into China-Eurasia Expo. (English translation by China Daily):

"... Eurasia is a beautiful and magical land. With abundant resources, a variety of landforms, diverse ethnic groups and pluralistic cultures, this land beams with vigor and vitality. … Our mutual political trust has deepened, trade and investment have rapidly expanded, regional and sub-regional cooperation has flourished, and the influence of the Shanghai Cooperation Organization (SCO), the Arab League, the Cooperation Council for the Arab States of the Gulf (GCC) and the South Asian Association for Regional Cooperation (SAARC) has been on the rise. The ancient Silk Road has regained its past vigor and vitality.

Over the past ten years, China's trade with countries in Central Asia, West Asia and South Asia has surged from 25.4 billion U.S. dollars to over 370 billion U.S. dollars, growing at an average annual rate of 30.8 percent. Chinese companies have made direct investment worth 250 billion U.S. dollars in Eurasian countries and signed project contracts worth about 470 billion U.S. dollars.

{BT insert: A 30.8% annual trade increase is a 97% increase in 2.5 years. Current Asian trade 370billion growing 97% is 728.9billion in Asian trade 30 months from now. US/China trade was 503 billion in 2011 and is not growing. Thus as I have noted, in 30 months, China can have trade growing (by 728.9 - 503 = 226 billion) without exporting anything to the US. With no dollar trade surplus earned, China will not help finance US´s more than trillion dollar annual deficits by buying US bonds. US deficits will increase even faster than now as US pays off China´s maturing US bonds with “printing press” dollars.}

The China-Kazakhstan oil and gas pipelines have started operation. The second cross-border railway between China and Kazakhstan has been successfully linked up. The China-Kyrgyzstan-Uzbekistan highway will be soon launched in full. A multi-dimensional silk road consisting of roads, railways, air flights, communications and oil and gas pipelines is taking shape.

In the new century, Eurasian countries and peoples should draw strength from our historical heritage and, in the same pioneering spirit of our ancestors and with greater confidence, proudly assume the responsibility entrusted by history and work together for new glory of the Silk Road and a better future of the Eurasian people. In conclusion, I wish the second China-Eurasia Expo and Economic Development and Cooperation Forum a complete success. Thank you. ..."

Read all five pages of it here: http://usa.chinadaily.com.cn/china/2012-09/03/content_15727475.htm

"... Eurasia is a beautiful and magical land. With abundant resources, a variety of landforms, diverse ethnic groups and pluralistic cultures, this land beams with vigor and vitality. … Our mutual political trust has deepened, trade and investment have rapidly expanded, regional and sub-regional cooperation has flourished, and the influence of the Shanghai Cooperation Organization (SCO), the Arab League, the Cooperation Council for the Arab States of the Gulf (GCC) and the South Asian Association for Regional Cooperation (SAARC) has been on the rise. The ancient Silk Road has regained its past vigor and vitality.

Over the past ten years, China's trade with countries in Central Asia, West Asia and South Asia has surged from 25.4 billion U.S. dollars to over 370 billion U.S. dollars, growing at an average annual rate of 30.8 percent. Chinese companies have made direct investment worth 250 billion U.S. dollars in Eurasian countries and signed project contracts worth about 470 billion U.S. dollars.

{BT insert: A 30.8% annual trade increase is a 97% increase in 2.5 years. Current Asian trade 370billion growing 97% is 728.9billion in Asian trade 30 months from now. US/China trade was 503 billion in 2011 and is not growing. Thus as I have noted, in 30 months, China can have trade growing (by 728.9 - 503 = 226 billion) without exporting anything to the US. With no dollar trade surplus earned, China will not help finance US´s more than trillion dollar annual deficits by buying US bonds. US deficits will increase even faster than now as US pays off China´s maturing US bonds with “printing press” dollars.}

The China-Kazakhstan oil and gas pipelines have started operation. The second cross-border railway between China and Kazakhstan has been successfully linked up. The China-Kyrgyzstan-Uzbekistan highway will be soon launched in full. A multi-dimensional silk road consisting of roads, railways, air flights, communications and oil and gas pipelines is taking shape.

In the new century, Eurasian countries and peoples should draw strength from our historical heritage and, in the same pioneering spirit of our ancestors and with greater confidence, proudly assume the responsibility entrusted by history and work together for new glory of the Silk Road and a better future of the Eurasian people. In conclusion, I wish the second China-Eurasia Expo and Economic Development and Cooperation Forum a complete success. Thank you. ..."

Read all five pages of it here: http://usa.chinadaily.com.cn/china/2012-09/03/content_15727475.htm

From: http://www.economist.com/content/global_debt_clock which allows three to be compared and gives debt color coded graphically by year and country.

Public (federal) debt for 2012

per person

Population

Debt as % of GDP

Annual increase of debt

BRAZIL

$1,301,848,633,880, which is less than12% of the US and slightly less than China´s but China has at least as much "hidden" in State Banks.

$6,706.42 less than 19% as much as US´s strangely low value listed but seven times higher than China (or ~3 times higher than China´s if "hidden" were there.)

194,082,240

54.3%

8.5%

USA

$11,106,684,426,230, Not sure why this is not more like 16 trillion. Need to read article to see what is not being counted.

$35,422.03 The US debt clock shows this as > $50,000 Again article is not counting a lot.

313,487,158 US population is only 61.5% larger than Brazil´s. China´s is 4.23 times bigger than US. So with fast growing incomes China is world´s main market.*

72.0% Again low value of debt listed is distorting - many report debt to GDP ratio is approaching 100%

13.7%

CHINA

$1,267,367,213,115

$955.20

1,326,398,907

15.7%

17.3%

* Another factor making China the world´s largest market for almost everything is it is not a "replacement" market - most are buying their first refrigerator, motor bike or car, etc. Also CCP is building infrastructure faster than rest of world (total) is so consumes ~60% of all copper, steel, etc.

Public (federal) debt for 2012

per person

Population

Debt as % of GDP

Annual increase of debt

BRAZIL

$1,301,848,633,880, which is less than12% of the US and slightly less than China´s but China has at least as much "hidden" in State Banks.

$6,706.42 less than 19% as much as US´s strangely low value listed but seven times higher than China (or ~3 times higher than China´s if "hidden" were there.)

194,082,240

54.3%

8.5%

USA

$11,106,684,426,230, Not sure why this is not more like 16 trillion. Need to read article to see what is not being counted.

$35,422.03 The US debt clock shows this as > $50,000 Again article is not counting a lot.

313,487,158 US population is only 61.5% larger than Brazil´s. China´s is 4.23 times bigger than US. So with fast growing incomes China is world´s main market.*

72.0% Again low value of debt listed is distorting - many report debt to GDP ratio is approaching 100%

13.7%

CHINA

$1,267,367,213,115

$955.20

1,326,398,907

15.7%

17.3%

* Another factor making China the world´s largest market for almost everything is it is not a "replacement" market - most are buying their first refrigerator, motor bike or car, etc. Also CCP is building infrastructure faster than rest of world (total) is so consumes ~60% of all copper, steel, etc.

Last edited by a moderator:

I have added some comments to data of post 23 which I did not have time to do yesterday. China probably "fudges" the data more than US does as they can, but it is quite hard to compare GDPs when what is produced and market mix is so different. Housing costs much less per square meter in China and a Bejing km long taxi ride cost only 10% of what same ride in NYC does. Also I point out that most of US´s GDP has zero value only two years later (e.g. 2010 rose bowl etc.) but most of China´s GDP will have value more than five years hence. Thus China´s "lasting value" GDP already is significantly greater than the US´s is (probably is at least double).Dang BillyT you seem to have your ears tuned in. You have heard a lot that's been helpful to this thread.

Do you think all those figures can be trusted from over there?

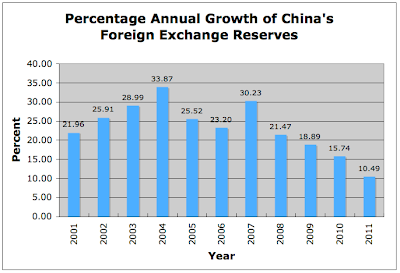

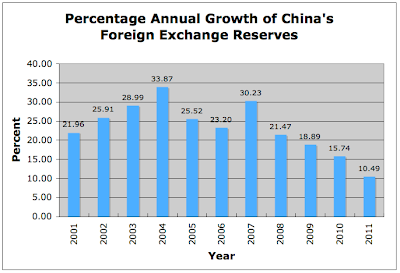

China is growing richer every year but now at slower annual percentage increase since 2007. This is mainly due to imports now growing faster* than exports.

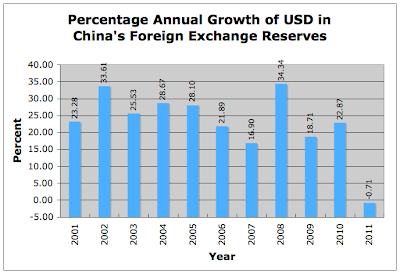

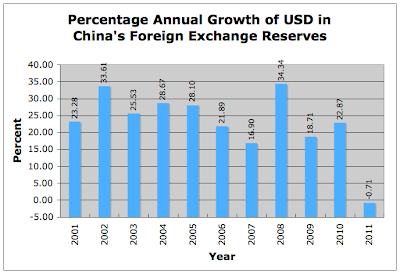

China´s dollar holdings are decreasing since late in 2010 as China uses dollars to buy, often in very long term, paid up front, contracts for oil and minerals etc.

Immediately below is new data on a rare** one month exception to the two year downward trend:

Immediately below is new data on a rare** one month exception to the two year downward trend:

*

** Being a small upward glitch in the two year downward trend was "news worthy" to ChinaDaily. China is currently slowly getting out of US bonds as it (like me) fears the coming dollar collapse and is now losing purchasing power (yield less than inflation) BUT China does not yet want to trigger a run on the dollar. Probably China will do so in 3 or 4 years IF the US & EU are not already in deep long lasting depression as then taking a ONE TIME loss on US bonds it still holds will very quickly be compensated by the EVERY YEAR lower prices it pays for its essential import of oil, etc. when US & EU are too broke to be doing much bidding against China for oil etc., which China has not already locked up with long term delivery contracts. For example: Brazil´s PetroBrass got 10 Billion dollars about three years ago and will pay it back by sending a daily average of 200,000 barrels of oil to China until 2030. - just one of many such long term delivery contracts.

For example: in 2012 Chain´s import bill will be nearly 2 trillion dollars and by 2015 more than 3 trillion. Thus, if bankrupt US & EU are buying little oil, etc. in 2015 and that holds China´s import prices to ~70% of what they would have been if US & EU were not in deep depression, China´s saving in only one of the "every year" saving pays back even a ONE TIME trillion dollar loss on the US Treasury bonds it dumped. Probably US and EU will be in deep depression by 2015, but if they are not, it just makes good economic sense for China to send them there by dumping its US bonds.

China´s dollar holdings are decreasing since late in 2010 as China uses dollars to buy, often in very long term, paid up front, contracts for oil and minerals etc.

http://usa.chinadaily.com.cn/business/2012-09/19/content_15768056.htm said:"..China in July increased its holding of US Treasury securities by $2.6 billion to $1149.6 billion, ranking it first among all countries and regions, according to latest data from US Treasury Department. China's holding in July was still lower than the $1166.2 holding of Jan, the highest point this year. ..'

*

AND more recent data shows trend is continuing:http://www.nytimes.com/2011/11/11/business/global/chinas-imports-rise-sharply-while-export-growth-slows.html said:"..China’s Imports Rise Sharply, While Export Growth Slows:

... China imports rose sharply in October {2011} while export growth continued to slow, according to data released Thursday that suggest robust domestic demand could offset the effects of weakening demand for Chinese goods in Europe and elsewhere. .."

http://www.tradingeconomics.com/china/imports said:"..China imports were worth 151.31 Billion USD in August of 2012. Historically, from 1990 until 2012, China Imports averaged 43.17 Billion USD reaching an all time high of 162.40 Billion USD in May of 2012 and a record low of 2.57 Billion USD in January of 1990. .."

** Being a small upward glitch in the two year downward trend was "news worthy" to ChinaDaily. China is currently slowly getting out of US bonds as it (like me) fears the coming dollar collapse and is now losing purchasing power (yield less than inflation) BUT China does not yet want to trigger a run on the dollar. Probably China will do so in 3 or 4 years IF the US & EU are not already in deep long lasting depression as then taking a ONE TIME loss on US bonds it still holds will very quickly be compensated by the EVERY YEAR lower prices it pays for its essential import of oil, etc. when US & EU are too broke to be doing much bidding against China for oil etc., which China has not already locked up with long term delivery contracts. For example: Brazil´s PetroBrass got 10 Billion dollars about three years ago and will pay it back by sending a daily average of 200,000 barrels of oil to China until 2030. - just one of many such long term delivery contracts.

For example: in 2012 Chain´s import bill will be nearly 2 trillion dollars and by 2015 more than 3 trillion. Thus, if bankrupt US & EU are buying little oil, etc. in 2015 and that holds China´s import prices to ~70% of what they would have been if US & EU were not in deep depression, China´s saving in only one of the "every year" saving pays back even a ONE TIME trillion dollar loss on the US Treasury bonds it dumped. Probably US and EU will be in deep depression by 2015, but if they are not, it just makes good economic sense for China to send them there by dumping its US bonds.

Last edited by a moderator:

Housing costs much less per square meter in China and a Bejing km long taxi ride cost only 10% of what same ride in NYC does.

Those kinds of things are trivial to control for, if you can get the data. That being why Beijing makes a point of not releasing the relevant data - they can't be double-checked and so can lie with great impunity. If the US government attempted such exercises in bullshit, they'd be found out and called out on it pretty much immediately.

Also the price of taxis in Beijing specifically is directly controlled by the government and heavily suppressed - exactly because they are included in the inflation calculations.

http://chovanec.wordpress.com/2012/04/21/bloomberg-inflated-notions/

Also I point out that most of US´s GDP has zero value only two years later (e.g. 2010 rose bowl etc.) but most of China´s GDP will have value more than five years hence. Thus China´s "lasting value" GDP already is significantly greater than the US´s is (probably is at least double).

You have never provided a usable definition of "lasting value GDP," let alone undertaken any serious comparison of such between the USA and China. You simply throw this assertion around as if it is well-defined and established with evidence, but in fact it is entirely vacuous.

Moreover your usage of the term "value" itself begs the question of what you even mean by such. Are you referring to "resale price," or something? Previously you've insisted that "infrastructure" has "lasting value" while refusing to account for malinvestment and mismatched demand.

If you're serious about this line of argumentation, you should follow through and try to make it meaningful. If you aren't going to follow through, you should stop repeating unsubstantiated, ill-defined speculations as solid fact around here.

US dollar holdings are decreasing since 2010 [...] two year downward trend [...]China is currently getting out of US bonds

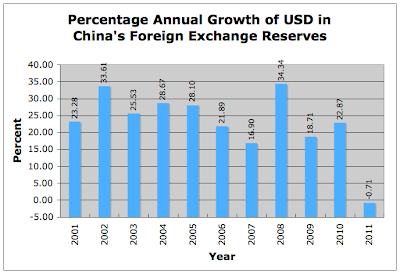

Your data does not show that. It shows a 22% growth in USD in China's foreign exchange reserves in 2010, and an insignificant decline in 2011. I.e., China's dollar holdings appear to be flat last year, after a strong upward trajectory stretching back decades.

Yes in first 9 or 10 months of 2010 China´s dollar holding did grow but except for the one very minor upward blip (less than 1/4 % change.) in July 2012 the 24 month trend has been downward. Read post again more carefully.Your data does not show that. It shows a 22% growth in USD in China's foreign exchange reserves in 2010, and an insignificant decline in 2011. I.e., China's dollar holdings appear to be flat last year, after a strong upward trajectory stretching back decades.

I´m following my policy of only correcting your first error, but will note that as told before three times, "lasting value" refers to thing that have most of the value two years later - thing like 1000+ Km of world´s best high speed rail road tracks Or a new power plant coming on line every 10 days, etc.... China´s dollar holdings are decreasing since late in 2010 as China uses dollars to buy, often in very long term, paid up front, contracts for oil and minerals etc. ... Immediately below is new data on a rare** one month exception to the two year downward trend:

** Being a small upward glitch in the two year downward trend was "news worthy" to ChinaDaily. China is currently slowly getting out of US bonds as it (like me) fears the coming dollar collapse and is now losing purchasing power (yield less than inflation) BUT China does not yet want to trigger a run on the dollar. Probably China will do so in 3 or 4 years IF the US & EU are not already in deep long lasting depression as then taking a ONE TIME loss on US bonds it still holds will very quickly be compensated by the EVERY YEAR lower prices it pays for its essential import of oil, etc. when US & EU are too broke to be doing much bidding against China for {remaining} oil etc., which China has not already locked up with long term delivery contracts. For example: Brazil´s PetroBrass got 10 Billion dollars about three years ago and will pay it back by sending a daily average of 200,000 barrels of oil to China until 2030. - just one of many such long term delivery contracts.http://usa.chinadaily.com.cn/business/2012-09/19/content_15768056.htm said:"..China in July increased its holding of US Treasury securities by $2.6 billion to $1149.6 billion, ranking it first among all countries and regions, according to latest data from US Treasury Department. China's holding in July was still lower than the $1166.2 holding of Jan, the highest point this year. ..'

For example: in 2012 Chain´s import bill will be nearly 2 trillion dollars and by 2015 more than 3 trillion. Thus, if bankrupt US & EU are buying little oil, etc. in 2015 and that holds China´s import prices to ~70% of what they would have been if US & EU were not in deep depression, China´s saving in only one of the "every year" saving pays back even a ONE TIME trillion dollar loss on the US Treasury bonds it dumped. Probably US and EU will be in deep depression by 2015, but if they are not, it just makes good economic sense for China to send them there by dumping its US bonds.

I´ll also note, as have not before: that an unoccupied new apartment of even a new city is not without value as China is in the process of urbanizing more peasants than half the entire US population and can not possibly schedule building of their needed new facilities in "just in time delivery mode." Often it makes good economic sense to build partly for now and partly for known future needs. Here is an example from the US:

Howard County Maryland highway 108´s bridge was damaged by hurricane Hazel more than 30 years ago and one bridge need to be replaced. They built two identical ones, side by side for about 40% more than cost of one. That second bridge saw no use for a long time. The new lanes that would used it came ~2 decades later. Do realize that China, in a little more than a decade, will build about the same amount of modern infrastructure* that the US now has (much of the US´s is 20+ years old and in poor shape) to server the new urban population? They are doing a better job of economical development of infrastructure than Howard County did with the second route 108 bridge ~20 years before need.

* Basic plan is for 100 new modern cities of at least one million population each.

Last edited by a moderator:

Yes in first 9 or 10 months of 2010 China´s dollar holding did grow but except for the one very minor upward blip (less than 1/4 % change.) in July 2012 the 24 month trend has been downward. Read post again more carefully.

There is no information to that effect in your post, no matter how carefully one reads it. You posted annual data for years up to 2011, showing strong year-on-year growth through 2010 and negligible change in 2011. You also posted that dollar reserves had again changed negligibly over the course of 2012 so far. The only trend visible there is a flat level of dollar FOREX holdings.

I´m following my policy of only correcting your first error,

You have not identified any errors on my part, and your "policy" of dodging substantive questions outright is contemptible.

but will note that as told before three times, "lasting value" refers to thing that have most of the value two years later - thing like 1000+ Km of world´s best high speed rail road tracks Or a new power plant coming on line every 10 days, etc.

And again, you skip right past the explicit points that have already been raised: how do you account for malinvestment? Are you simply assuming that it does not exist? Those high-speed railways are operating at a massive loss due to lack of ridership. Electricity consumption in China has been flat for a year now, so there is nobody to buy the output of those new power plants.

From http://chovanec.wordpress.com/2012/09/13/wsj-chinas-solyndra-economy/ (emphases mine):

This summer, the NYSE-listed LDK Solar, the world’s second largest polysilicon solar wafer producer, defaulted on $95 million owed to over 20 suppliers. The company lost $589 million in the fourth quarter of 2011 and another $185 million in the first quarter of 2012, and has shed nearly 10,000 jobs. The government in LDK’s home province of Jiangxi scrambled to pledge $315 million in public bailout funds, terrified that any further defaults could pull down hundreds of local companies.

Meanwhile another NYSE-listed Chinese solar company, Suntech, revealed on July 30 that the German government bonds an affiliate pledged as security for a $689 million bank loan it guaranteed never existed. Suntech, the world’s largest producer of solar panels, claims it was the victim of fraud. Considering Suntech already owed $3.6 billion (for a debt-asset ratio of 82%), and lost $149 million in the fourth quarter of 2011 and $133 million in the first quarter of 2012, many analysts believe the company could go bankrupt without a sizable government bailout.

Chinese solar companies blame many of their woes on the antidumping tariffs recently imposed by the U.S. and Europe. The real problem, however, is rampant overinvestment driven largely by subsidies. Since 2010, the price of polysilicon wafers used to make solar cells has dropped 73%, according to Maxim Group, while the price of solar cells has fallen 68% and the price of solar modules 57%. At these prices, even low-cost Chinese producers are finding it impossible to break even.

Wind power is seeing similar overcapacity. China’s top wind turbine manufacturers, Goldwind and Sinovel, saw their earnings plummet by 83% and 96% respectively in the first half of 2012, year-on-year. Domestic wind farm operators Huaneng and Datang saw profits plunge 63% and 76%, respectively, due to low capacity utilization. China’s national electricity regulator, SERC, reported that 53% of the wind power generated in Inner Mongolia province in the first half of this year was wasted. One analyst told China Securities Journal that “40-50% of wind power projects are left idle,” with many not even connected to the grid.

A few years ago, Shenzhen-based BYD (short for “Build Your Dreams”) was a media darling that brought in Warren Buffett as an investor. It was going to make China the dominant player in electric automobiles. Despite gorging on green energy subsidies, BYD sold barely 8,000 hybrids and 400 fully electric cars last year, while hemorrhaging cash on an ill-fated solar venture. Company profits for the first half of 2012 plunged 94% year-on-year.

China’s high-speed rail ambitions put the Ministry of Railways so deeply in debt that by the end of last year it was forced to halt all construction and ask Beijing for a $126 billion bailout. Central authorities agreed to give it $31.5 billion to pay its state-owned suppliers and avoid an outright default, and had to issue a blanket guarantee on its bonds to help it raise more. While a handful of high-traffic lines, such as the Shanghai-Beijing route, have some prospect of breaking even, Prof. Zhao Jian of Beijing Jiaotong University compared the rest of the network to “a 160-story luxury hotel where only 11 stories are used and the occupancy rate of those floors is below 50%.”

China’s Railway Ministry racked up $1.4 billion in losses for the first six months of this year, and an internal audit has uncovered dangerous defects due to lax construction on 12 new lines, which will have to be repaired at the cost of billions more. Minister Liu Zhijun, the architect of China’s high-speed rail system, was fired in February 2011 and will soon be prosecuted on corruption charges that reportedly include embezzling some $120 million. One of his lieutenants, the deputy chief engineer, is alleged to have funneled $2.8 billion into an offshore bank account.

Meanwhile another NYSE-listed Chinese solar company, Suntech, revealed on July 30 that the German government bonds an affiliate pledged as security for a $689 million bank loan it guaranteed never existed. Suntech, the world’s largest producer of solar panels, claims it was the victim of fraud. Considering Suntech already owed $3.6 billion (for a debt-asset ratio of 82%), and lost $149 million in the fourth quarter of 2011 and $133 million in the first quarter of 2012, many analysts believe the company could go bankrupt without a sizable government bailout.

Chinese solar companies blame many of their woes on the antidumping tariffs recently imposed by the U.S. and Europe. The real problem, however, is rampant overinvestment driven largely by subsidies. Since 2010, the price of polysilicon wafers used to make solar cells has dropped 73%, according to Maxim Group, while the price of solar cells has fallen 68% and the price of solar modules 57%. At these prices, even low-cost Chinese producers are finding it impossible to break even.

Wind power is seeing similar overcapacity. China’s top wind turbine manufacturers, Goldwind and Sinovel, saw their earnings plummet by 83% and 96% respectively in the first half of 2012, year-on-year. Domestic wind farm operators Huaneng and Datang saw profits plunge 63% and 76%, respectively, due to low capacity utilization. China’s national electricity regulator, SERC, reported that 53% of the wind power generated in Inner Mongolia province in the first half of this year was wasted. One analyst told China Securities Journal that “40-50% of wind power projects are left idle,” with many not even connected to the grid.

A few years ago, Shenzhen-based BYD (short for “Build Your Dreams”) was a media darling that brought in Warren Buffett as an investor. It was going to make China the dominant player in electric automobiles. Despite gorging on green energy subsidies, BYD sold barely 8,000 hybrids and 400 fully electric cars last year, while hemorrhaging cash on an ill-fated solar venture. Company profits for the first half of 2012 plunged 94% year-on-year.

China’s high-speed rail ambitions put the Ministry of Railways so deeply in debt that by the end of last year it was forced to halt all construction and ask Beijing for a $126 billion bailout. Central authorities agreed to give it $31.5 billion to pay its state-owned suppliers and avoid an outright default, and had to issue a blanket guarantee on its bonds to help it raise more. While a handful of high-traffic lines, such as the Shanghai-Beijing route, have some prospect of breaking even, Prof. Zhao Jian of Beijing Jiaotong University compared the rest of the network to “a 160-story luxury hotel where only 11 stories are used and the occupancy rate of those floors is below 50%.”

China’s Railway Ministry racked up $1.4 billion in losses for the first six months of this year, and an internal audit has uncovered dangerous defects due to lax construction on 12 new lines, which will have to be repaired at the cost of billions more. Minister Liu Zhijun, the architect of China’s high-speed rail system, was fired in February 2011 and will soon be prosecuted on corruption charges that reportedly include embezzling some $120 million. One of his lieutenants, the deputy chief engineer, is alleged to have funneled $2.8 billion into an offshore bank account.

There is no meaningful way to assess the value of an investment without analyzing demand for it. Bridges to nowhere, ghost towns, idled cement factories, etc. are not examples of "lasting value." They are the equivalent of taking big piles of money and setting it on fire.

I´ll also note, as have not before: that an unoccupied new apartment of even a new city is not without value as China is in the process of urbanizing more peasants than half the entire US population and can not possibly schedule building of their needed new facilities in "just in time delivery mode."

The fact that China has lots of people who might one day want apartments does not mean that they have lots of people who want the apartments that have been built and have the money and willingness to pay a price for them that would exceed what they cost to build. If you spend a million bucks building an apartment building and it sits empty for five years before being sold for 200k, then your "lasting value" represents the destruction of 80% of the money you invested. And probably the developers who built that go bankrupt before that sale ever happens, since they owe a ton to the banks who financed this stuff (who in turn require government bail-out). Does that sound like efficient resource allocation and wise investment to you? Why do you refuse to actually account all of the relevant costs?

Often it makes good economic sense to build partly for now and partly for known future needs.

And to the extent that you overestimate future needs, that portion of what you build ends up representing an outright loss, and not "lasting value." The fact that China has a bunch of people who might some day want to occupy this infrastructure does not mean that its value will end up exceeding what it cost to build.

Which is to say that the implication that all investment spending represents "lasting value" is bullshit. You have to do an analysis of what the actual demand ends up being, and an accounting of the losses eaten by the financial system and then, ultimately, taxpayer.

It seems that you simply want to advocate for investment in fixed assets. I would have no problem with you making the statement "Chinas fixed asset investment exceeds America's." But when you try to re-label that as "lasting value," while skipping right over the basic questions of what "value" is and how it is measured, and present no analysis of demand or financing costs, then you are simply bullshitting.

Moreover, there is the basic point that China is a developing country with a drastically lower standard of living than the USA, and so it is totally normal and expected that they would dedicate a lot more resources to development of basic infrastructure. Your implication that the two should be compared directly, as if they were comparable economies at comparable levels of development, is again an exercise in bullshit.

Last edited:

Yes the graph of China´s YoY change in US Treasury holdings was up 22% for the full year 2010, but the last few months had holdings decreases (a very significant change from long standing prior trends) and those monthly decreases have continued thru latest data available with one exception, a less than 1/4 of a percent glitch upward in July 2012 which was a news worthy (to ChinaDaily) change, but not a very meaningful break in the steady but slow reduction that started in November of 2010.... You posted annual data for years up to 2011, showing strong year-on-year growth through 2010 and negligible change in 2011. ...

I.e. in late 2010 China switched to the current policy of slowly decreasing in their holding of US Treasury bonds - a dramatic policy change from the rapid monthly increases of more than a decade that blew them past Japan as world´s the largest holder of Treasury bonds.

I.e. in July 2012 China´s holdings went up $2.6 billion to $1149.6 billion according to latest data from US Treasury Department, but China's holding even with the July increase were still lower than the $1166.2 holding of January 2012. That is: China´s holding of Treasury bonds went DOWN down 16.6 billion during the first 7 months of 2012. (If trend continues, China´s holdings will be down at least 25 billion in 2012.)

I cannot be sure why the CCP switched policy in late 2010 but doing that is 100% consistent with my long term predictions. Here from my post 26 is why, IMO, that China is only very slowly reducing it holdings:

"... China is currently slowly getting out of US bonds as it (like me) fears the coming dollar collapse and is now losing purchasing power (yield less than inflation) BUT China does not yet want to trigger a run on the dollar. Probably China will do so in 3 or 4 years IF the US & EU are not already in deep long lasting depression as then taking a ONE TIME loss on US bonds it still holds will very quickly be compensated by the EVERY YEAR lower prices it pays for its essential import of oil, etc. when US & EU are too broke to be doing much bidding against China for {the remaining} oil etc. which China has not already bought and paid for in long term future delivery contracts ...

In 2012 Chain´s import bill will be nearly 2 trillion dollars and by 2015 more than 3 trillion. Thus, if bankrupt US & EU are buying little oil, etc. in 2015 and that holds China´s import prices to only ~70% of what they would have been if US & EU were not in deep depression, China´s saving in only one of the "every year" saving pays back even a ONE TIME trillion dollar loss on the US Treasury bonds it dumped. Probably US and EU will be in deep depression by mid 2015, but if they are not, it just makes good economic sense for China to send them there by dumping its US bonds. .."

"Yet" because China wants to build its trade with S. America, Africa and especially other Asian nations before ceasing to export to the US. In 2.5 years at the current rate of growth with other Asian nations China´s trade with them will INCREASE more that its total exports to the US in 2011! Then in 3 (or 4 years at the most), China can tell the US to: Go to hell. - We don´t need to sell anything to you and so no longer will we finance your growing debts or lend you funds to buy our production with.

Also China wants a few years more to grow its domestic demand - it is proving hard to get the population to reduce their extremely saving rates even by giving double digit real annual salary increases and cutting their out of pocket medical expense in half, etc.

Yes the graph of China´s YoY change in US Treasury holdings was up 22% for the full year 2010, but the last few months had holdings decreases

The post in question contained no data showing such. So you cannot fault me for complaining that the post in question contained no data showing such.

Indeed, you have not provided any such data anywhere that I can see. Just unsourced assertions from yourself.

That is: China´s holding of Treasury bonds went DOWN down 16.6 billion during the first 7 months of 2012.

That is a pretty small decrease, only around 1%. At that rate, China will still be holding about trillion dollars in Forex reserves come 2020.

No- No "assertions" by me -just the facts from other sources:The post in question contained no data showing such. So you cannot fault me for complaining that the post in question contained no data showing such.

Indeed, you have not provided any such data anywhere that I can see. Just unsourced assertions from yourself. ...

{post 26 in part}: ... China´s dollar holdings are decreasing since late in 2010 as China uses dollars to buy, often in very long term, paid up front, contracts* for oil and minerals etc.

Note last blue bar is below the xero line - a net DECREASE in treasury holdings.

Immediately below is new {19Sept12} data on a rare one month exception to the two year downward trend:

* For example: Brazil´s PetroBrass got 10 Billion dollars about three years ago and will pay it back by sending a daily average of 200,000 barrels of oil to China until 2030. - just one of many such long term delivery contracts. I don´t remember exactly when PetroBras actually got the agreed the 10 billion dollars, but it would have been near the end of 2010 and may be part of why China´s reserves in Dollars started to turn down then.http://usa.chinadaily.com.cn/business/2012-09/19/content_15768056.htm said:"..China in July increased its holding of US Treasury securities by $2.6 billion to $1149.6 billion, ranking it first among all countries and regions, according to latest data from US Treasury Department. China's holding in July was still lower than the $1166.2 holding of Jan, the highest point this year. ..'

Unfortunately for US there are still many poor willing to work long hours for low wages in other parts of Asia, like Vietnam but things are definitely getting better very rapidly for the Chinese and the richer ones are buying gold and French wines (more sent to China than to the US now!)In late 1951, Appliance Park Building 1 started rolling GE-brand washing machines and dryers off its assembly line. Just a few years later, 16,000 union workers in six massive factory buildings were churning out 60,000 GE ranges, refrigerators, and dishwashers a week.

A massive 10-acre building, Appliance Park Building 1, or AP1, was the first factory to come online at General Electric's (NYSE: GE) state-of the-art Appliance Park near Louisville, Kentucky.

At 1,000 total acres, Appliance Park had its own zip code: 40225. It had its own fire department and power plant. Appliance Park also employed the first computer to ever be used in a factory. By 1973, 23,000 people worked at this mecca of American manufacturing.

But just ten years later, the golden age for U.S. factories was over. In 1984, Appliance Park employed fewer workers than it did in 1955. American manufacturing went from boom to bust in just 30 years. ... The New Age of American Manufacturing

The challenge to American factories has been plain to see. In 2000, the average Chinese worker made $0.52 cents an hour, the equivalent of 20 or 30 Appliance Park employees. That was pretty attractive to the corporate bottom line. And let's not overlook the cost-conscious American consumer, who might complain about how “Made in China” costs American jobs, but still want to buy $30 running shoes at Marshall's...

The American manufacturing sector lost an estimated six million jobs in the first decade of the new millennium. But Chinese workers are now enjoying an improved standard of living, as wages have risen from $0.52 and hour to $8.50 an hour over the last 10 years. Private sector wages in China rose 11% in 2011 and another 12% in 2012....

On February 10, 2012, GE opened the first new assembly line at Appliance Park in 55 years to make water heaters. These new water heaters made at Appliance Park in Louisville, Kentucky, sold for $1,299. The same heater made in China sold for $1,599. ... About a month later, another new assembly line opened at Appliance Park to make high-end refrigerators. Still more new lines opened to make washers and dryers and dishwashers. ...

Californians urged to cut use of water

Don't say you were not warned:http://www.planning.org/news/daily/story.htm?story_id=194406097 said:Jan. 18--SAN FRANCISCO -- Gov. Jerry Brown announced a state of emergency Friday that has been all but official for weeks: California is in a drought. Brown urged Californians to reduce water use by 20 percent, saying "we're facing perhaps the worst drought that California has ever seen since records began being kept about 100 years ago." The emergency declaration comes as the state suffers through dry conditions for a third straight year.

* US lack leadership ability to move Great Lakes water to the dry SW. (Less than 1/5 the cost of China's "half Nile" as existing rivers could be used for most of it.) Congress is not interested in costly projects that have first benefit a decade or more after they cease running for re-election.... Lake Powell and Lake Mead supply much of the water needed by S. W. USA and they are going dry:The US does not have an organizational structure to solve its largest water problem, with Congress mainly interested in the next election and not funding multi-decade-long water projects with first benefits long after they have left office. With cost of ~10% of China's 62 billion dollars, US could transfer water from the Great Lakes, mainly via existing rivers, to save the South West from disaster, but that will not be done by Congress.

Scripps Institution of Oceanography / University of California, San Diego says: "... There is a 50 percent chance Lake Mead, a key source of water for millions of people in the southwestern United States, will be dry by 2021 if climate changes as expected and future water usage is not curtailed, ... Without Lake Mead and neighboring Lake Powell, the Colorado River system has no buffer to sustain the population of the Southwest through an unusually dry year, or worse, a sustained drought. In such an event, water deliveries would become highly unstable and variable, ..." From: http://scrippsnews.ucsd.edu/Releases/?releaseID=876

China has larger and worse permanent drought problem in its arid NE, but is solving it with decades long planning*:

For scale, note the large earth mover at edge, bottom center.

Eastern and central parts will be operational in 2014 after more than a decade of intense construction and testing. The Nile flow is just over 80 cubic kilometers per year. (reference at: http://www.google.com/#fp=b1848aaff8811878&q=annual+flow+of+nile+river) and a cubic Km is 1000^3 cubic meters, or Nile moves 80 billion cubic meters vs. China is moving 44.8 billion cubic meters. I.e. the Nile moves less than twice as much water as China will but the Nile moves its water slightly more than twice a far. No other man-made water project come even close (not even within 3%) to what China has done to improve the economic health of the nation as world moves into the era of water shortages! China's "half Nile" does a trick nature's Nile can't do: It delivers water to the Beijing area 45 meters higher than its source! (2.8 billion kWh/year pumping energy) China started funding studies for this world's largest water project in 1950!