http://www.thehillsgroup.org/depletion2_002.htm

Depletion: A determination for the world's petroleum reserve

Study Overview

Scattered around the globe are 48,000 oil fields that supply the world's need for petroleum. Each field has its own unique set of characteristics - and there is considerable diversity between them. Arriving at an estimate for the remaining extractable reserve is usually attempted by adding together the quantity of petroleum believed to be present in each field. It is the number of fields, and their distinctive compositions that make an accurate determination for the depletion status of the world's petroleum reserve a challenge.

When a field is discovered the quantity of petroleum that might be available for extraction is usually estimated by applying a very complex set of equations (the Buckley-Leverett equation, and its extrapolations). These equations require a number of initial values that are often based on the judgment of an experienced reservoir engineer. One result of this procedure is the phenomena known as reserve growth. As time progresses it is sometimes discovered that more crude oil can be extracted from a field than was originally predicted. Of course, the reservoir did not grow, it took 5.3 to 570 million years for it to form! Reserve growth occurs because there was an error in the original estimate.

When thousands of fields are evaluated, each with its own margin of error, the result is a range of values that can vary by 50% or more. To further complicate the issue nature rarely, if ever, makes any of her creations exactly the same. Petroleum is a complex mixture of hydrocarbons, coming from a world wide distribution of fields. Eleven million tons of it are extracted daily. Yet, each barrel is assumed to be exactly like every other barrel of the 72 million produced that day. Obviously, this is an inadequate evaluation method for a commodity that is essential for the continuation of modern society.

There are a number of methods employed by science, and engineering to help solve intractable problems. The most widely used, and dependable of these methods are those that are based on fundamental physical laws. The best method to use can often be identified by first isolating the specific characteristics of the problem. Petroleum has a very unique, and specific characteristic; it is the world's primary energy provider.

Energy is a fundamental physical property, and for more than a century its application has been investigated by science and engineering. A vast amount of literature has been dedicated to what has been discovered, and the procedures for the application of those discoveries. To determine the status of the world's petroleum reserve "

Depletion: A determination for the world's petroleum reserve" analyzes the system's energy state. This method has several advantages over the quantity measurement approach.

The methodology employed by the study is termed "exergy" analysis. Exergy in the vernacular of the science of thermodynamics means:

"the maximum amount of work that can be extracted from a system". The system under study is a unit of petroleum. The maximum amount of work that can be extracted from a unit of petroleum is calculated using the physical properties of the crude oil in question, and equations that have been derived from studies of the First and Second Law. These values are then used in the construction of a mathematical model that can predict the status of the world's petroleum reserve with a much smaller margin of error than can be provided by the quantity approach.

The smaller error results from a much more compact model than what is produced by the quantity approach. To be implemented, the quantity approach requires the evaluation of thousands of values; usually many of them are not precisely known. The energy approach (the

ETP model,

Total

Production

Energy) requires only

three. The model is derived from the fundamental physical properties of petroleum, First and Second Law statements, and the cumulative production history of petroleum. To generate values the model requires the mass of crude removed over a period of time, the mass of water removed, and the temperature of the reservoir. Although somewhat complex from a mathematical perspective, it employs only one value of which we are not very certain; that is, petroleum's production history.

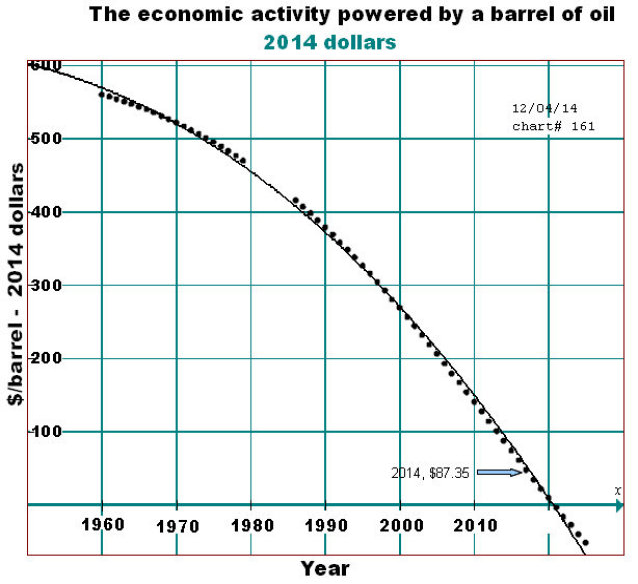

Petroleum production is a process. The process includes the extraction, processing (refining), and distribution of crude oil and its products. Each step of the process requires an input of energy to be completed. As time progresses the needed energy input increases. This occurs because of entropy production (a Second Law mandate) in the process. When the needed energy input exceeds the exergy of the petroleum, the petroleum can no longer act as an energy source. It has lost it primary value as a commodity. This is denoted as "

the dead state"; the point when no additional work can be extracted from the system (a unit of petroleum).

Entropy production results in an increase in the irreversibilities of a system. Irreversibilities are a measure of the energy cost of the processes of a system. The

ETP model is a summation of the irreversibilities present in the petroleum production system over a period of time. Subtracting the irreversibilities in the system at a point in time from its exergy gives the amount of energy available to be used by the non-energy goods producing sector of the economy. The model does this on a specific (per unit) bases. The unit employed is the US gallon.

To be of value a model must be predictive. To have confidence in its ability to predict future events with an acceptable level of certainty, it must also be capable of reproducing past events with a reasonable level of accuracy. This implies, of course, that the past events being reproduced are known with reasonable accuracy. There are few past events which have occurred in the history of petroleum production that can be stated with certainty. The one catagory for which we are almost 100% certain is its price history.

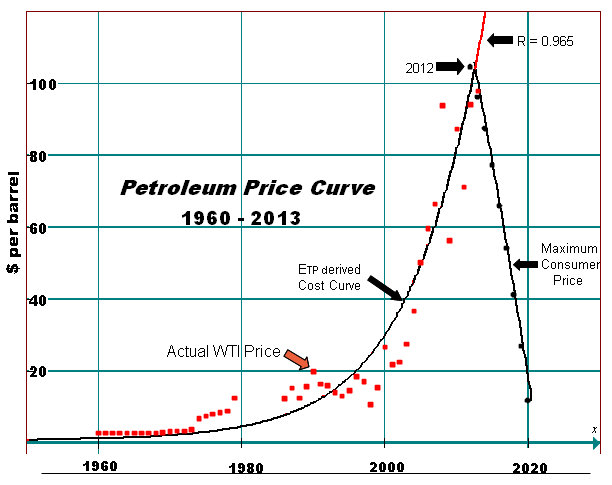

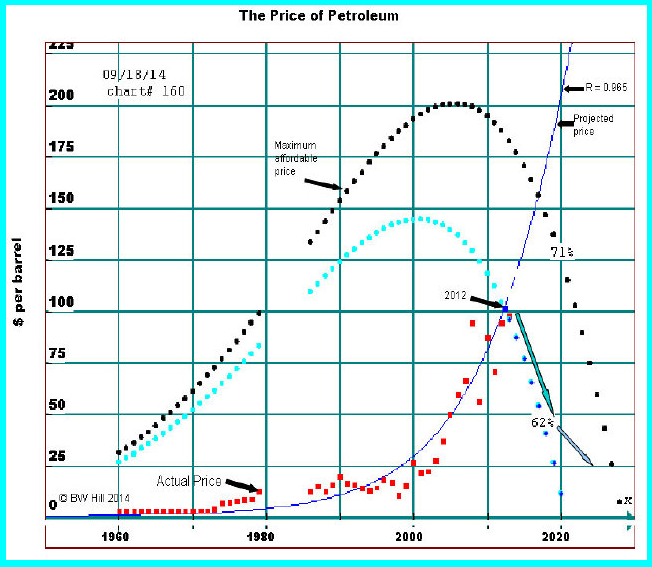

The price of crude oil varies daily, even by the hour, but when viewed from an energy perspective its longer term value closely follows a well defined mathematical function. That mathematical function is derived from the

ETP model. The price of petroleum is driven by its cost of production, and its cost of production is controlled by the energy required to produce it. This simple relationship gives a means to map the past, and future of petroleum prices. Mapped to past pricing the relationship gives an almost perfect fit. Because the model is based on First and Second Law premises future projections can be expected to perform as well as those that were applied to the past.

The

ETP model is derived from a Second Law statement, which means that it is, also, a Second Law statement. Because the model is based on First and Second Law premises, and because we have reason to have confidence in petroleum's price history, petroleum’s cumulative production history can also be determined with a level of confidence similar to that which exists for its price. The model is reliant on one variable, petroleum's cumulative production history, and this can be verified from its price history. The strength of the

ETP model depends on two factors, its bases in First and Second premises, and the confidence that can be attributed to petroluem's price history.

Optimistic estimates place the world's total petroleum reserve at 4,300 billion barrels. Of that quantity the

ETP model predicts that it will be possible to extract 1,760.5 billion barrels. This constitutes 40.9% of the total reserve. This is in agreement with assessments that have been made by several noted petro-gelogists. The principal difference between the use of an energy approach, and conventional methods is that the energy approach provides for the development of a reliable predictor for petroleum's future pricing. The model shows that petroleum's ability to supply the energy needed to sustain its own production process is declining. This is experienced by the consumer as increasing price. The model demonstrates why the two events are synchronized. The

ETP model adds an important, and needed element toward a deeper understanding of the depletion status of our most essential extractive commodity.

~The Hills Group

---Futilitist